Idaho State Tax Commission: Your Ultimate Guide To Understanding Taxes In Idaho

Ever wondered how the Idaho State Tax Commission works? Well, buckle up because we’re diving deep into the world of taxes in Idaho! If you live in Idaho or plan to move there, understanding the ins and outs of the tax system is crucial. The Idaho State Tax Commission plays a key role in managing everything from income taxes to property taxes, and we’re here to break it all down for you. So, whether you’re a business owner, a homeowner, or just someone trying to figure out their tax obligations, this guide has got you covered.

Taxes can be a headache, no doubt about it. But when you know what to expect, it becomes less intimidating. The Idaho State Tax Commission is the backbone of the state’s tax system, ensuring everything runs smoothly. This article will walk you through everything you need to know about the commission, its responsibilities, and how it impacts you as a taxpayer. We’ll also sprinkle in some tips to help you navigate the tax landscape with ease.

From understanding the basics of state income tax to exploring the latest updates in tax laws, we’ll cover it all. So, grab a cup of coffee, get comfy, and let’s unravel the mysteries of the Idaho State Tax Commission together. Trust me, by the end of this, you’ll feel like a tax guru!

What is the Idaho State Tax Commission?

Let’s start with the basics. The Idaho State Tax Commission is essentially the state agency responsible for overseeing all tax-related matters in Idaho. Think of it as the tax watchdog that ensures everyone pays their fair share. The commission handles everything from collecting taxes to enforcing tax laws and providing guidance to taxpayers.

Established to streamline the tax process, the Idaho State Tax Commission works tirelessly to ensure transparency and fairness in the tax system. Whether it’s filing your annual income tax return or paying your property taxes, the commission is there to make sure everything is in order. Plus, they offer resources and tools to help taxpayers understand their obligations better.

Key Responsibilities of the Idaho State Tax Commission

Now that you know what the Idaho State Tax Commission is, let’s take a closer look at its key responsibilities:

- Income Tax Management: The commission oversees the collection of state income taxes from both individuals and businesses.

- Property Tax Oversight: They ensure property taxes are assessed and collected accurately across the state.

- Sales and Use Tax Regulation: The commission manages sales taxes and ensures businesses comply with tax regulations.

- Education and Assistance: Providing resources and guidance to taxpayers is a major part of their role. They offer workshops, online tools, and customer support to help people navigate the tax system.

These responsibilities highlight the importance of the Idaho State Tax Commission in maintaining a fair and efficient tax system. Without them, the state’s finances would be in chaos!

Understanding Idaho State Income Tax

Taxes are one of those things you can’t avoid, and income tax is a big part of it. In Idaho, the state income tax is progressive, meaning the more you earn, the higher the tax rate. The Idaho State Tax Commission sets these rates and ensures they’re applied correctly.

How Idaho State Income Tax Works

Here’s a quick rundown of how Idaho state income tax works:

- Progressive Tax Rates: Idaho has several tax brackets, with rates ranging from 1.125% to 6.5% depending on your income level.

- Filing Deadlines: Just like federal taxes, Idaho state income taxes are due by April 15th each year. The Idaho State Tax Commission provides extensions if needed.

- Exemptions and Deductions: The commission allows certain exemptions and deductions to help taxpayers reduce their taxable income. This includes standard deductions and itemized deductions.

Understanding these basics can save you a lot of headaches during tax season. Plus, the Idaho State Tax Commission offers plenty of resources to help you file your taxes correctly.

Property Taxes in Idaho

Another big aspect of the Idaho tax system is property taxes. If you own a home or land in Idaho, you’re subject to property taxes. The Idaho State Tax Commission plays a crucial role in ensuring these taxes are assessed and collected fairly.

How Property Taxes Are Calculated

Property taxes in Idaho are based on the assessed value of your property. Here’s how it works:

- Assessment Process: Local assessors determine the market value of your property, and the Idaho State Tax Commission ensures this process is accurate and fair.

- Tax Rates: Each county in Idaho sets its own property tax rate, but the commission oversees these rates to ensure they comply with state laws.

- Appeals: If you disagree with your property tax assessment, the commission provides a process for appealing the decision.

Property taxes are a significant expense for homeowners, so understanding how they’re calculated is essential. The Idaho State Tax Commission offers resources to help you navigate this process.

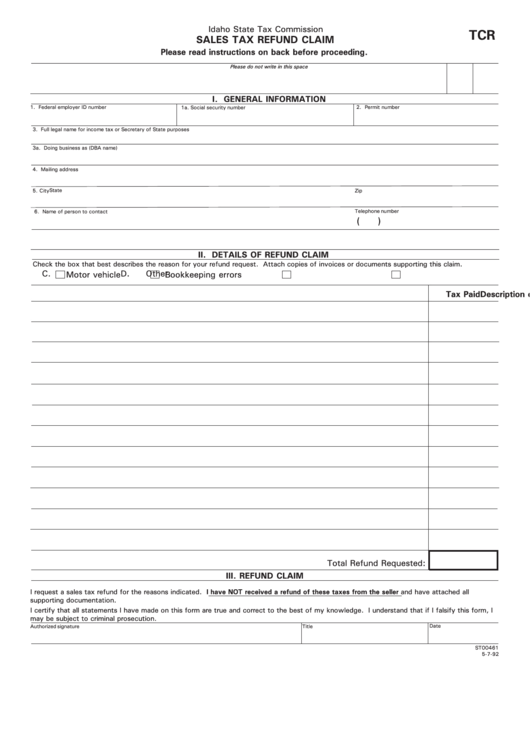

Sales and Use Taxes in Idaho

When you shop in Idaho, you’re likely paying sales tax. The Idaho State Tax Commission regulates sales and use taxes to ensure businesses and consumers comply with the law.

Understanding Sales Tax in Idaho

Here’s what you need to know about sales tax in Idaho:

- Statewide Sales Tax Rate: Idaho has a statewide sales tax rate of 6%. Some counties and cities may add additional local taxes.

- Exemptions: Certain items, like groceries and prescription medications, are exempt from sales tax. The Idaho State Tax Commission provides a list of exempt items to help businesses and consumers stay compliant.

- Use Tax: If you purchase items from out of state and don’t pay sales tax, you may owe use tax. The commission helps businesses and individuals calculate and pay this tax.

Sales and use taxes are a vital source of revenue for Idaho, and the Idaho State Tax Commission ensures these taxes are collected fairly and efficiently.

Resources Provided by the Idaho State Tax Commission

The Idaho State Tax Commission doesn’t just collect taxes; they also provide a wealth of resources to help taxpayers. Whether you’re a business owner or an individual, the commission offers tools and guidance to make the tax process easier.

Online Tools and Workshops

Here are some of the resources available through the Idaho State Tax Commission:

- Online Filing: The commission offers an online portal for filing income tax returns and paying property taxes.

- Workshops and Seminars: They host workshops to educate taxpayers about the latest tax laws and regulations.

- FAQs and Guides: The commission provides comprehensive guides and FAQs to answer common tax questions.

These resources are invaluable for anyone looking to stay informed about their tax obligations. The Idaho State Tax Commission is committed to helping taxpayers navigate the often-complex world of taxes.

Recent Updates and Changes

Tax laws are constantly evolving, and the Idaho State Tax Commission keeps up with the latest changes. Whether it’s new legislation or updated regulations, the commission ensures taxpayers are aware of these changes.

Key Updates to Watch For

Here are some recent updates to keep an eye on:

- Tax Rate Adjustments: The commission periodically reviews and adjusts tax rates to reflect economic changes.

- New Exemptions: They introduce new exemptions and deductions to help taxpayers save money.

- Technology Enhancements: The commission continues to improve its online systems to make tax filing easier and more secure.

Staying informed about these updates can help you take advantage of new opportunities and avoid potential pitfalls. The Idaho State Tax Commission is your go-to source for the latest tax news.

How the Idaho State Tax Commission Benefits You

While paying taxes might not be the most exciting part of your day, the Idaho State Tax Commission plays a vital role in improving your quality of life. The revenue generated from taxes funds essential services like schools, roads, and public safety.

Impact on Your Daily Life

Here’s how the Idaho State Tax Commission benefits you:

- Improved Infrastructure: Tax revenue helps maintain and improve roads, bridges, and other infrastructure.

- Quality Education: Schools across Idaho rely on tax funding to provide quality education.

- Public Safety: Law enforcement and emergency services are supported by tax dollars.

Without the Idaho State Tax Commission, many of these services would suffer. So, while paying taxes might not be fun, it’s essential for maintaining a thriving community.

Common Misconceptions About the Idaho State Tax Commission

There are a lot of myths and misconceptions about the Idaho State Tax Commission. Let’s clear up a few of them:

- Myth: The Commission is Out to Get You: While they enforce tax laws, the commission is also there to help taxpayers. They offer resources and support to ensure compliance.

- Myth: You Can’t Appeal Tax Decisions: The commission provides a clear process for appealing tax assessments and decisions.

- Myth: Taxes Are Too Complicated: With the resources provided by the commission, navigating the tax system is easier than you think.

Understanding these misconceptions can help you approach taxes with a more positive mindset. The Idaho State Tax Commission is here to help, not hinder.

Conclusion

In conclusion, the Idaho State Tax Commission is a vital part of Idaho’s tax system. From managing income taxes to overseeing property taxes, they ensure everything runs smoothly. By understanding their role and responsibilities, you can better navigate the tax landscape and make informed decisions.

So, whether you’re filing your taxes, appealing a property tax assessment, or staying up-to-date on the latest tax laws, the Idaho State Tax Commission is your go-to resource. Don’t forget to take advantage of the tools and guidance they offer to make the tax process easier for you.

And hey, if you found this article helpful, why not share it with your friends and family? Or leave a comment below with any questions or thoughts you have. Let’s keep the conversation going and make taxes a little less intimidating for everyone!

Table of Contents

- What is the Idaho State Tax Commission?

- Key Responsibilities of the Idaho State Tax Commission

- Understanding Idaho State Income Tax

- Property Taxes in Idaho

- Sales and Use Taxes in Idaho

- Resources Provided by the Idaho State Tax Commission

- Recent Updates and Changes

- How the Idaho State Tax Commission Benefits You

- Common Misconceptions About the Idaho State Tax Commission

- Conclusion