Altra Credit Union: Your Financial Partner For Growth And Security

When it comes to managing your finances, finding a reliable partner is crucial. Altra Credit Union stands out as a trusted institution that offers personalized services and competitive rates. Whether you're looking to save, borrow, or invest, this credit union has everything you need to achieve your financial goals. In today's uncertain economic climate, having a solid financial foundation matters more than ever, and Altra Credit Union is here to help you build it.

Let’s be real, folks. Banks and financial institutions can sometimes feel like a maze. You know what I mean—endless fees, complicated terms, and a lack of personal touch. That’s where Altra Credit Union steps in. This isn’t just another bank; it’s a member-owned cooperative that prioritizes its members’ success over profits. Think of it as your financial BFF who’s got your back every step of the way.

Now, if you’re wondering why you should consider Altra Credit Union over other options, stick around. We’re diving deep into what makes them special, how they operate, and why so many people trust them with their hard-earned money. Whether you’re new to credit unions or already part of the Altra family, this article will give you all the info you need to make smart financial decisions.

About Altra Credit Union

Founded on the principles of community support and financial empowerment, Altra Credit Union has been serving individuals and businesses for decades. Unlike traditional banks, credit unions are member-owned, meaning they focus on providing value to their members rather than generating profits for shareholders. This unique structure allows Altra to offer lower interest rates on loans, higher returns on savings, and fewer fees overall.

So, what exactly does Altra Credit Union bring to the table? Well, they’ve got a wide range of services tailored to meet the needs of their members. From checking accounts and mortgages to personal loans and credit cards, Altra has everything you need to manage your money effectively. Plus, they’re always innovating to stay ahead of the curve, offering cutting-edge digital tools and mobile banking options.

Why Choose Altra Credit Union?

Here’s the deal: when you choose Altra Credit Union, you’re not just opening an account—you’re becoming part of a community. Members enjoy perks like:

- Competitive interest rates on loans and savings

- Low or no fees for most services

- Personalized customer service

- Access to a vast network of ATMs nationwide

- Advanced security features to protect your accounts

Plus, Altra is deeply committed to giving back to the communities they serve. They sponsor local events, support nonprofit organizations, and offer financial education programs to empower members. It’s this kind of dedication that sets them apart from the competition.

Membership at Altra Credit Union

Becoming a member of Altra Credit Union is easier than you might think. Eligibility requirements vary depending on where you live and work, but generally, anyone who lives, works, or worships in their designated service area can join. Once you become a member, you’ll have access to all the benefits Altra has to offer.

How to Join Altra Credit Union

The process is straightforward and can often be completed online in just a few minutes. Here’s how you can get started:

- Visit the Altra Credit Union website and click on the “Join Now” button.

- Fill out the application form with your personal information.

- Make a small deposit into your new share account (usually around $25).

- That’s it! You’re now officially a member and ready to take advantage of all the great services Altra offers.

Oh, and don’t worry if you’re not sure whether you qualify. The team at Altra is super helpful and can guide you through the process to ensure you meet the requirements.

Altra Credit Union Services

One of the reasons Altra Credit Union is so popular is the wide range of services they provide. Let’s break down some of the key offerings:

Savings Accounts

Whether you’re saving for a rainy day or planning for long-term goals, Altra’s savings accounts have got you covered. With competitive interest rates and no hidden fees, these accounts make it easy to grow your wealth over time. Plus, you can set up automatic transfers to help you save consistently without even thinking about it.

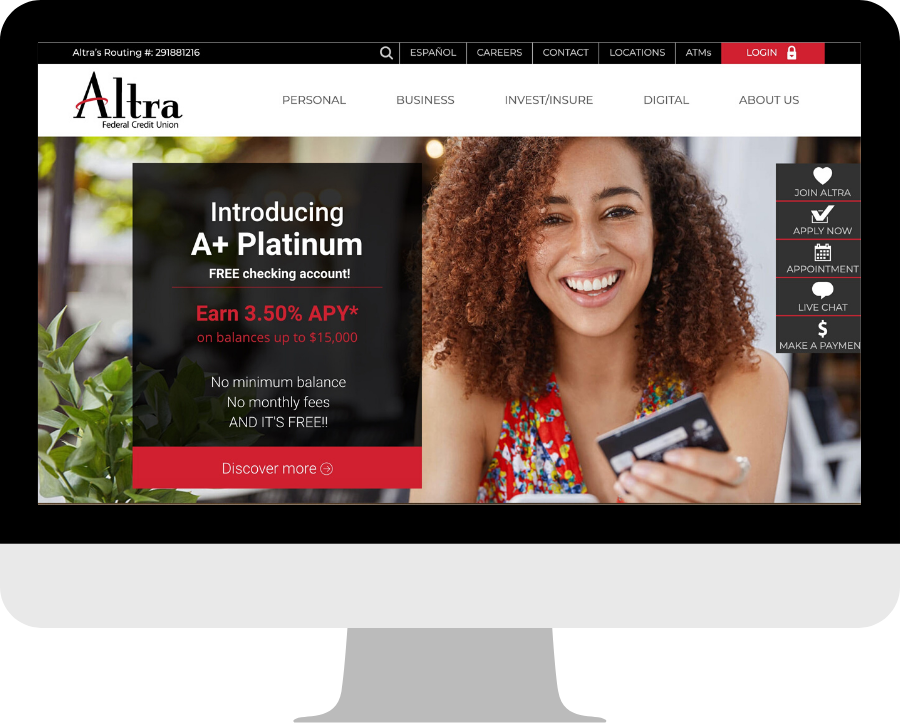

Checking Accounts

Gone are the days of paying ridiculous fees for basic banking services. Altra’s checking accounts come with features like free bill pay, mobile check deposit, and access to thousands of surcharge-free ATMs across the country. And let’s not forget their award-winning mobile app, which makes managing your money a breeze.

Loans and Credit Cards

Need a loan for a car, home, or other big purchase? Altra offers a variety of loan options with competitive rates and flexible terms. Their credit cards also come with great rewards programs and low interest rates, making them a smart choice for everyday spending.

Technology and Convenience

In today’s fast-paced world, convenience is key. That’s why Altra Credit Union invests heavily in technology to ensure their members have access to the tools they need to manage their finances anytime, anywhere. Their mobile app allows you to check balances, transfer funds, pay bills, and even deposit checks—all from the palm of your hand.

Online Banking

Altra’s online banking platform is user-friendly and packed with features. You can view transaction history, set up alerts, and manage your accounts all in one place. It’s like having a personal banker available 24/7.

Mobile Banking

With Altra’s mobile app, you can handle all your banking tasks on the go. From checking your balance to transferring money between accounts, everything is just a few taps away. Plus, the app includes advanced security features to keep your information safe.

Community Involvement

Altra Credit Union isn’t just about helping members achieve their financial goals—they’re also passionate about giving back to the communities they serve. Through partnerships with local organizations and charitable initiatives, they work to create positive change and support those in need.

Financial Education Programs

Empowering members with knowledge is a top priority for Altra. They offer workshops, webinars, and resources designed to help individuals improve their financial literacy and make informed decisions. Topics range from budgeting and saving to investing and retirement planning.

Community Sponsorships

From sponsoring local sports teams to supporting nonprofit events, Altra is actively involved in community life. By investing in these initiatives, they help foster a sense of connection and belonging among members and non-members alike.

Security and Trust

When it comes to your money, security is non-negotiable. Altra Credit Union takes safeguarding your information seriously and employs state-of-the-art technology to protect your accounts. They also provide resources to help you stay vigilant against fraud and identity theft.

Advanced Security Features

Altra’s online and mobile platforms include features like two-factor authentication, biometric login options, and real-time transaction alerts. These tools help ensure that only authorized users can access your accounts.

Fraud Prevention Resources

Staying one step ahead of scammers is crucial in today’s digital age. Altra provides tips and resources to help members recognize and avoid common scams. They also offer free credit monitoring services to keep an eye on your credit report for suspicious activity.

Testimonials and Reviews

Don’t just take our word for it—here’s what some satisfied Altra Credit Union members have to say:

“I’ve been with Altra for years, and I couldn’t be happier. Their customer service is top-notch, and they always go the extra mile to help me out.” — Jane D.

“Switching to Altra was one of the best decisions I ever made. Their mobile app is awesome, and I love the fact that they give back to the community.” — Mark R.

These testimonials highlight the personal touch and commitment to excellence that define Altra Credit Union.

Future Plans and Innovations

Altra Credit Union isn’t resting on its laurels—they’re constantly looking for ways to improve and expand their offerings. Some exciting developments on the horizon include enhanced digital tools, expanded branch locations, and new financial products designed to meet the evolving needs of their members.

Upcoming Enhancements

Keep an eye out for updates to the mobile app, including improved navigation and additional features. Altra is also exploring partnerships with fintech companies to bring even more value to their members.

Conclusion

In summary, Altra Credit Union is more than just a financial institution—it’s a partner in your journey toward financial success. With competitive rates, personalized service, and a commitment to community, they offer everything you need to achieve your goals. So why wait? Take the first step today and see what Altra can do for you.

Before you go, here’s a quick recap of the key points we covered:

- Altra Credit Union is a member-owned cooperative focused on serving its members.

- They offer a wide range of services, including savings accounts, loans, and credit cards.

- Membership is easy to obtain and comes with numerous benefits.

- Altra invests in technology and security to provide a convenient and safe banking experience.

- They’re deeply committed to giving back to the communities they serve.

Now it’s your turn! If you found this article helpful, feel free to share it with friends and family. And if you’re ready to join Altra Credit Union, head over to their website and get started. Your financial future is waiting!

Table of Contents

- About Altra Credit Union

- Why Choose Altra Credit Union?

- Membership at Altra Credit Union

- Altra Credit Union Services

- Technology and Convenience

- Community Involvement

- Security and Trust

- Testimonials and Reviews

- Future Plans and Innovations

- Conclusion