Rent To Own: The Ultimate Guide To Transforming Your Living Situation

Let’s face it, folks. Renting a place can sometimes feel like throwing money into a bottomless pit. But what if I told you there’s a game-changing option out there called rent 2 own? That’s right—rent to own could be your golden ticket to owning a home without the traditional hurdles of a mortgage. Stick with me, because we’re about to deep-dive into everything you need to know!

Now, before we get into the nitty-gritty, let’s break it down real quick. Rent to own, or lease-to-own, is basically a deal where you rent a property with the option to buy it later. Think of it as a trial period for homeownership. It’s not just about finding a roof over your head—it’s about building equity and securing your future. So, buckle up, because we’re going on a journey to uncover all the ins and outs of this incredible opportunity.

Whether you’re a first-time homebuyer, someone recovering from a credit setback, or simply not ready to commit to a traditional mortgage, rent 2 own might just be the perfect solution for you. But don’t just take my word for it. In this guide, we’ll break it all down step by step, so you can make an informed decision. Ready? Let’s dive in!

Here’s a quick rundown of what we’ll cover:

- What is Rent to Own?

- How Does Rent to Own Work?

- Benefits of Rent to Own

- Drawbacks of Rent to Own

- Who Should Consider Rent to Own?

- Important Considerations

- Finding the Right Property

- Negotiating the Agreement

- Tips for Success

- Final Thoughts

What is Rent to Own?

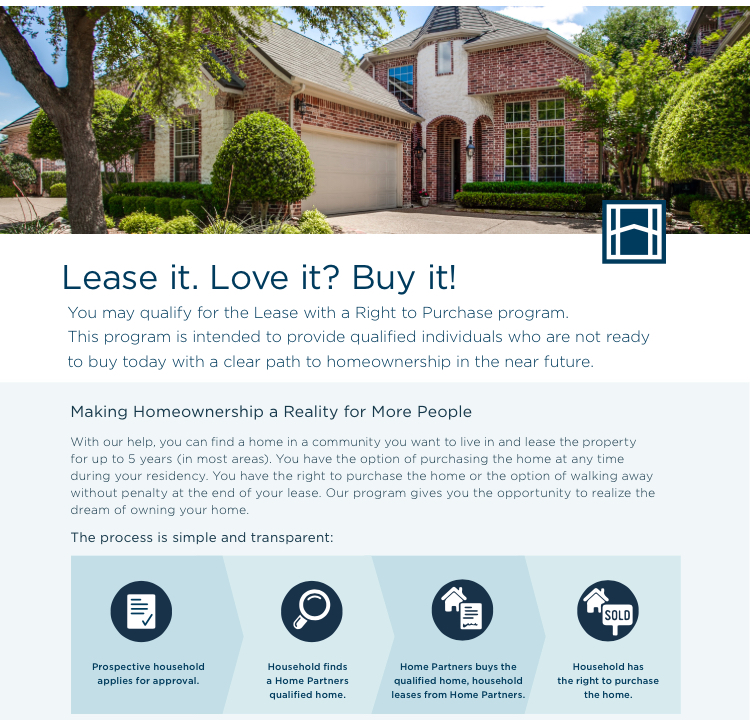

Alright, let’s start with the basics. Rent to own, also known as lease-to-own, is a unique arrangement between a tenant and a landlord. Instead of just renting a property, you’re given the option to purchase the home at the end of the lease period. This setup is perfect for people who aren’t quite ready for a traditional mortgage but still want to work towards homeownership.

Here’s the kicker: during the lease period, a portion of your rent payments can go towards the eventual purchase price of the home. This is often referred to as a “rent credit.” It’s like getting a head start on your down payment without actually having to fork over a lump sum of cash upfront. Sounds pretty sweet, right?

How Does Rent to Own Work in Practice?

Now, let’s break it down further. When you enter into a rent 2 own agreement, you’ll typically sign two separate contracts. The first one is a standard lease agreement, which outlines the terms of your rental period. The second contract is the lease-option agreement, which gives you the right—but not the obligation—to buy the home at a predetermined price when the lease term ends.

This arrangement is great for buyers who need time to improve their credit score, save up for a down payment, or simply test out the neighborhood before committing to a purchase. For sellers, it’s a way to secure a tenant who has a vested interest in maintaining the property, plus they get the added bonus of a guaranteed buyer at the end of the lease.

How Does Rent to Own Work?

Let’s get into the nuts and bolts of how rent 2 own works. First off, you’ll need to find a property that’s available for rent to own. Once you’ve found the perfect place, it’s time to negotiate the terms of the agreement. This is where things can get a little tricky, so it’s important to have a clear understanding of what you’re getting into.

Here’s a quick rundown of the key components:

- Lease Term: This is the length of time you’ll be renting the property before you have the option to buy. It’s usually anywhere from one to three years.

- Purchase Price: The price at which you can buy the home at the end of the lease term is typically set in advance. This gives you peace of mind knowing exactly what you’ll be paying for the property.

- Rent Credit: A portion of your monthly rent payments may be applied towards the purchase price of the home. This is essentially like building equity while you rent.

- Option Fee: This is a non-refundable fee that gives you the right to purchase the home at the end of the lease term. Think of it as a down payment on the option to buy.

Now, it’s important to note that rent 2 own agreements can vary widely depending on the seller and the market. That’s why it’s crucial to read the fine print and, if necessary, consult with a real estate professional to ensure you’re getting a fair deal.

Benefits of Rent to Own

So, why should you consider rent to own? Let’s talk about some of the major advantages:

1. Flexibility

One of the biggest benefits of rent 2 own is the flexibility it offers. You’re not locked into a purchase, so if something changes—like your financial situation or your feelings about the neighborhood—you can simply walk away at the end of the lease term. No strings attached.

2. Building Equity

With rent 2 own, you have the opportunity to build equity while you rent. The rent credit you积累 during the lease term can significantly reduce the amount you’ll need for a down payment when it’s time to buy. It’s like getting a head start on homeownership without the upfront costs.

3. Time to Improve Credit

Let’s face it, not everyone has perfect credit. Rent to own gives you the time to improve your credit score, pay off debts, and save up for a down payment. By the time the lease term ends, you’ll be in a much stronger financial position to secure a mortgage.

Drawbacks of Rent to Own

Of course, no deal is perfect, and rent to own is no exception. Here are a few potential downsides to consider:

1. Higher Rent Costs

Because a portion of your rent is going towards the purchase price, you might end up paying more than you would for a traditional rental. Make sure you crunch the numbers to ensure it’s worth it in the long run.

2. Non-Refundable Option Fee

The option fee is a non-refundable payment that gives you the right to buy the home at the end of the lease term. If you decide not to purchase the property, you’ll lose that money. It’s important to weigh the risks before signing on the dotted line.

3. Market Fluctuations

The purchase price is usually set at the beginning of the lease term, which means you could end up overpaying if the market drops. On the flip side, if the market rises, you’ll be getting a great deal. It’s all about timing and market conditions.

Who Should Consider Rent to Own?

Not everyone is a good candidate for rent to own. Here are a few scenarios where it might make sense:

- First-Time Homebuyers: If you’re new to the world of homeownership and want to test the waters before committing to a purchase, rent to own could be a great option.

- People with Credit Issues: If you’ve had credit problems in the past but are working to improve your score, rent to own gives you the time to get back on your feet.

- Those Unsure About Location: If you’re not sure about a particular neighborhood or city, rent to own allows you to try it out before making a permanent commitment.

Ultimately, rent to own is all about finding the right fit for your unique situation. If you’re ready to take the leap, it could be the perfect stepping stone to homeownership.

Important Considerations

Before diving headfirst into a rent 2 own agreement, there are a few important things to keep in mind:

1. Read the Fine Print

Make sure you fully understand the terms of the agreement before signing anything. Pay close attention to details like the lease term, purchase price, rent credit, and option fee. If anything seems unclear, don’t hesitate to ask questions.

2. Work with a Real Estate Professional

Having a knowledgeable real estate agent or attorney on your side can make a huge difference. They can help you negotiate the terms of the agreement and ensure you’re getting a fair deal.

3. Plan for the Future

Think about where you’ll be financially at the end of the lease term. Will you be in a position to secure a mortgage? Will you still want to live in the same neighborhood? Planning ahead can save you a lot of headaches down the road.

Finding the Right Property

Finding a rent to own property isn’t always easy, but it’s definitely doable. Here are a few tips to help you in your search:

- Network with Real Estate Agents: Many agents specialize in rent to own properties and can help you find the perfect match.

- Check Online Listings: Websites like Zillow and Realtor.com often have sections dedicated to rent to own properties.

- Attend Open Houses: Sometimes the best deals come from meeting sellers in person and negotiating a rent to own agreement on the spot.

Remember, the key is to find a property that meets your needs and fits within your budget. Don’t rush the process—take your time to find the right place.

Negotiating the Agreement

Once you’ve found a property, it’s time to negotiate the terms of the agreement. Here are a few tips to help you get the best deal:

1. Be Prepared to Negotiate

Don’t be afraid to haggle over the lease term, purchase price, rent credit, and option fee. Every little bit counts when it comes to saving money in the long run.

2. Get Everything in Writing

Make sure all the terms of the agreement are clearly outlined in writing. This will protect you in case any disputes arise down the road.

3. Consider Future Market Conditions

Think about how the housing market might change over the next few years. If you’re confident the market will rise, you might be willing to pay a higher purchase price upfront.

Tips for Success

Here are a few final tips to help you succeed with rent to own:

- Stay Organized: Keep track of all your payments and documents related to the agreement. This will make things much easier when it’s time to buy.

- Focus on Financial Improvement: Use the lease term to improve your credit score, save money, and prepare for homeownership.

- Be Proactive: Don’t wait until the last minute to start the mortgage process. Start working with a lender early to ensure a smooth transition.

By following these tips, you’ll be well on your way to a successful rent to own experience.

Final Thoughts

There you have it, folks. Rent to own can be a fantastic option for those looking to take the next step towards homeownership without the immediate commitment of a traditional mortgage. While it’s not without its challenges, the potential benefits make it worth considering for many buyers.

So, what are you waiting for? Start exploring your options today and see if rent 2 own is the right fit for you. And don’t forget to share this article with anyone who might find it helpful. Together, let’s make homeownership dreams a reality!