Rockland Federal Credit Union: Your Trusted Financial Partner

When it comes to managing your finances, you deserve a partner who truly understands your needs. Rockland Federal Credit Union stands out as a beacon of reliability, offering personalized services tailored to its members. Whether you're saving for the future, securing a loan, or just looking for a safe place to store your money, this credit union has got your back. Let’s dive into what makes Rockland Federal Credit Union a top choice for financial stability.

There’s something special about credit unions that banks just can’t replicate. They’re member-owned, meaning they work for YOU—not shareholders. This fundamental difference is why Rockland Federal Credit Union consistently ranks high in customer satisfaction. It’s not just about banking; it’s about building relationships and empowering people to achieve their financial goals.

Now, if you’re wondering how Rockland Federal Credit Union stacks up against other financial institutions, we’ve got you covered. In this article, we’ll break down everything you need to know about their services, benefits, and why they might be the perfect fit for your financial journey. So, grab a coffee, sit back, and let’s explore together!

Table of Contents

- Introduction to Rockland Federal Credit Union

- A Brief History of Rockland Federal Credit Union

- Who Can Join Rockland Federal Credit Union?

- Key Services Offered by Rockland Federal Credit Union

- Loan Options and Their Benefits

- Savings Accounts and Plans

- Digital Banking Solutions

- Community Involvement and Impact

- Ensuring Your Financial Security

- Rockland vs. Traditional Banks

Introduction to Rockland Federal Credit Union

Rockland Federal Credit Union isn’t just another financial institution; it’s a community-driven organization focused on serving its members. Founded with a mission to provide affordable financial services, it quickly became a trusted name in the region. So, what sets them apart from traditional banks? Well, it all comes down to their core values—member empowerment, transparency, and integrity.

One of the biggest perks of joining Rockland Federal Credit Union is the personalized approach they take with each member. Unlike big banks that often feel impersonal, Rockland makes sure you’re treated like family. They offer competitive rates on loans, savings accounts, and more, ensuring you get the most out of your money.

But wait, there’s more! As a member, you also have a say in how the credit union operates. Voting rights and board elections give you a voice in shaping its future. That’s democracy in action, folks!

A Brief History of Rockland Federal Credit Union

Established in [YEAR], Rockland Federal Credit Union has grown significantly over the decades. Starting as a small operation serving local employees, it has expanded its reach while staying true to its roots. Today, it serves thousands of members across [LOCATION], offering a wide range of financial products and services.

Over the years, the credit union has adapted to changing times, embracing new technologies and expanding its offerings. From introducing online banking to launching mobile apps, Rockland has stayed ahead of the curve without losing sight of its core mission: helping members succeed financially.

Key Milestones in Rockland’s Journey

- 1960s: First opened its doors to serve local workers.

- 1980s: Introduced ATMs and expanded branch locations.

- 2000s: Launched digital banking platforms for convenience.

- 2020s: Enhanced cybersecurity measures to protect members.

Who Can Join Rockland Federal Credit Union?

Membership at Rockland Federal Credit Union isn’t open to everyone, but don’t let that discourage you. Eligibility criteria are designed to ensure the credit union remains a tight-knit community of like-minded individuals. Here’s who qualifies:

- Residents of [SPECIFIC AREA OR COUNTY].

- Employees of partner organizations or businesses.

- Family members of existing members.

Joining is simple! All you need is a small deposit to open an account, and voila—you’re part of the Rockland family. Plus, once you’re a member, you remain one for life, even if you move away or change jobs. How cool is that?

Key Services Offered by Rockland Federal Credit Union

Rockland Federal Credit Union offers a comprehensive suite of services designed to meet every financial need. From checking accounts to investment opportunities, they’ve got you covered. Let’s take a closer look at some of their standout offerings:

Checking Accounts

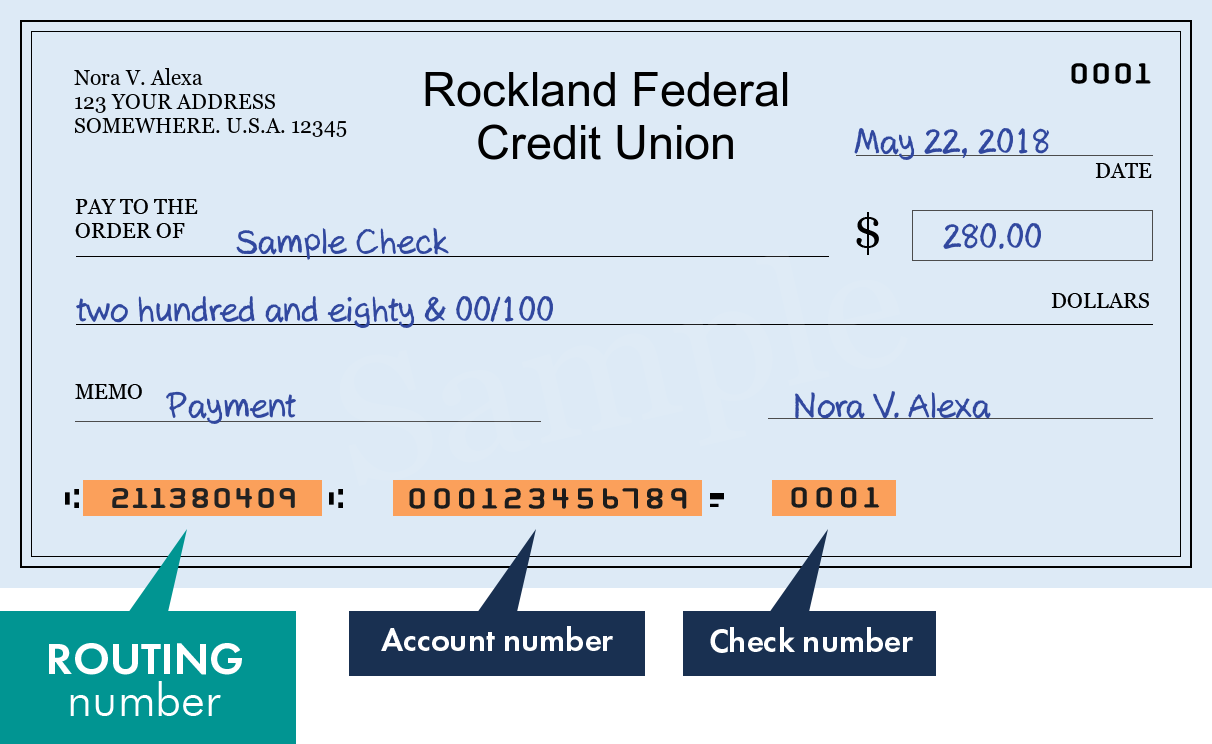

With no hidden fees and competitive interest rates, Rockland’s checking accounts make managing your daily expenses a breeze. Plus, their free debit card gives you easy access to your funds wherever you go.

Savings Accounts

Whether you’re saving for a rainy day or planning for retirement, Rockland’s savings accounts offer attractive returns. They also provide specialized accounts for kids and teens, helping young people learn the value of saving early.

Investment Opportunities

Looking to grow your wealth? Rockland offers a variety of investment options, including IRAs and certificates of deposit (CDs). Their expert advisors can help you create a personalized plan to reach your financial goals.

Loan Options and Their Benefits

When it comes to borrowing money, Rockland Federal Credit Union shines with its flexible loan options. Whether you need a personal loan, a mortgage, or an auto loan, they’ve got competitive rates and terms that work for you.

Personal Loans

Need cash for unexpected expenses? Rockland’s personal loans offer quick approval and low-interest rates, making them a smart choice for short-term needs.

Mortgage Loans

Buying a home is one of the biggest investments you’ll ever make. Rockland’s mortgage specialists can guide you through the process, offering fixed-rate and adjustable-rate options to suit your budget.

Auto Loans

Whether you’re buying a new car or refinancing an existing loan, Rockland’s auto loans come with great rates and flexible terms. Plus, they often partner with local dealerships to make the process smoother.

Savings Accounts and Plans

Saving money is essential for financial security, and Rockland Federal Credit Union makes it easy. Their savings accounts come with no monthly fees and competitive interest rates, ensuring your money grows over time.

For those saving for specific goals, Rockland offers specialized plans like education savings accounts and holiday clubs. These tools help you stay disciplined and achieve your targets faster.

Benefits of Rockland’s Savings Accounts

- No hidden fees.

- Competitive interest rates.

- Easy access to funds.

Digital Banking Solutions

In today’s fast-paced world, convenience matters. Rockland Federal Credit Union understands this and offers cutting-edge digital solutions to make banking effortless.

Through their mobile app, you can check balances, transfer funds, pay bills, and even deposit checks—all from the palm of your hand. Plus, their 24/7 customer support ensures you’re never left in the dark.

Key Features of Rockland’s Mobile App

- Real-time account updates.

- Mobile check deposits.

- Bill payment options.

Community Involvement and Impact

Rockland Federal Credit Union isn’t just about banking—it’s about giving back. The credit union actively participates in community initiatives, supporting local charities, schools, and organizations.

From hosting financial literacy workshops to sponsoring local events, Rockland plays a vital role in fostering economic growth and stability in the community. It’s this commitment to social responsibility that sets them apart from traditional banks.

Ensuring Your Financial Security

Your financial security is Rockland Federal Credit Union’s top priority. They employ state-of-the-art security measures to protect your accounts, including encryption, fraud monitoring, and multi-factor authentication.

In addition, all deposits are insured by the NCUA up to $250,000, giving you peace of mind knowing your money is safe. If you ever suspect fraudulent activity, their dedicated team is ready to assist you promptly.

Rockland vs. Traditional Banks

So, how does Rockland Federal Credit Union stack up against traditional banks? Let’s compare:

| Feature | Rockland Federal Credit Union | Traditional Banks |

|---|---|---|

| Member Ownership | Yes | No |

| Lower Fees | Yes | Sometimes |

| Personalized Service | Highly Focused | Less Personal |

As you can see, Rockland offers distinct advantages that traditional banks simply can’t match.

Kesimpulan

Rockland Federal Credit Union is more than just a financial institution—it’s a partner in your journey toward financial well-being. With its member-focused approach, competitive services, and commitment to community, it’s no wonder so many people choose Rockland for their banking needs.

So, what are you waiting for? Join the Rockland family today and experience the difference for yourself. Don’t forget to share this article with friends and family who might benefit from the knowledge. Together, let’s build a brighter financial future!